Strategies for renewable energy generators to optimize PPA contracts

July 12, 2024

Overview

In Japan, the demand for corporate PPAs (Power Procurement Agreements for Renewable Energy) is growing due to the increasing demand for renewable energy sources. This article explores key steps in PPA pricing strategies, including forecast analysis and data collection.

PPA Status and Market Trends

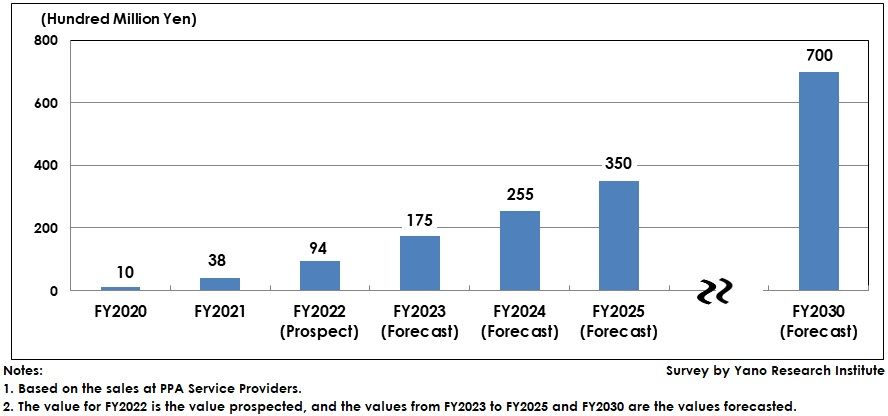

The service market for renewable energy installation, known as Power Purchase Agreements (PPAs), is attracting attention in the Japanese electricity market. Demand for PPAs as an alternative to the FIT system is growing and is expected to grow to 35 billion yen in FY2025 and 70 billion yen in FY2030.

Exhibit 1

PPA Contract Pricing Strategies Based on Predictive Analysis

Although PPAs allow for flexible contract terms and conditions, price optimization requires ingenuity; the following steps can be considered in pursuing PPA pricing optimization:

1. Data collection: Collect historical PPA pricing data and market trends.

2. Predictive modeling: Predict future price trends using machine learning and time series analysis.

3. Market analysis: Evaluate market conditions and competitor strategies.

4. Risk assessment: Evaluate risks associated with the contract and incorporate them into the pricing model.

5. Scenario planning: Evaluate the impact of different market scenarios and adjust pricing strategies.

6. Dynamic pricing: Employ approaches that adjust prices in response to real-time demand fluctuations.

7. Continuous monitoring and optimization: Evaluate the impact of different market scenarios and adjust pricing strategies.

These steps will enable data-driven decision-making and increase your competitiveness in the renewable energy market.

Strategic Approach to Optimization

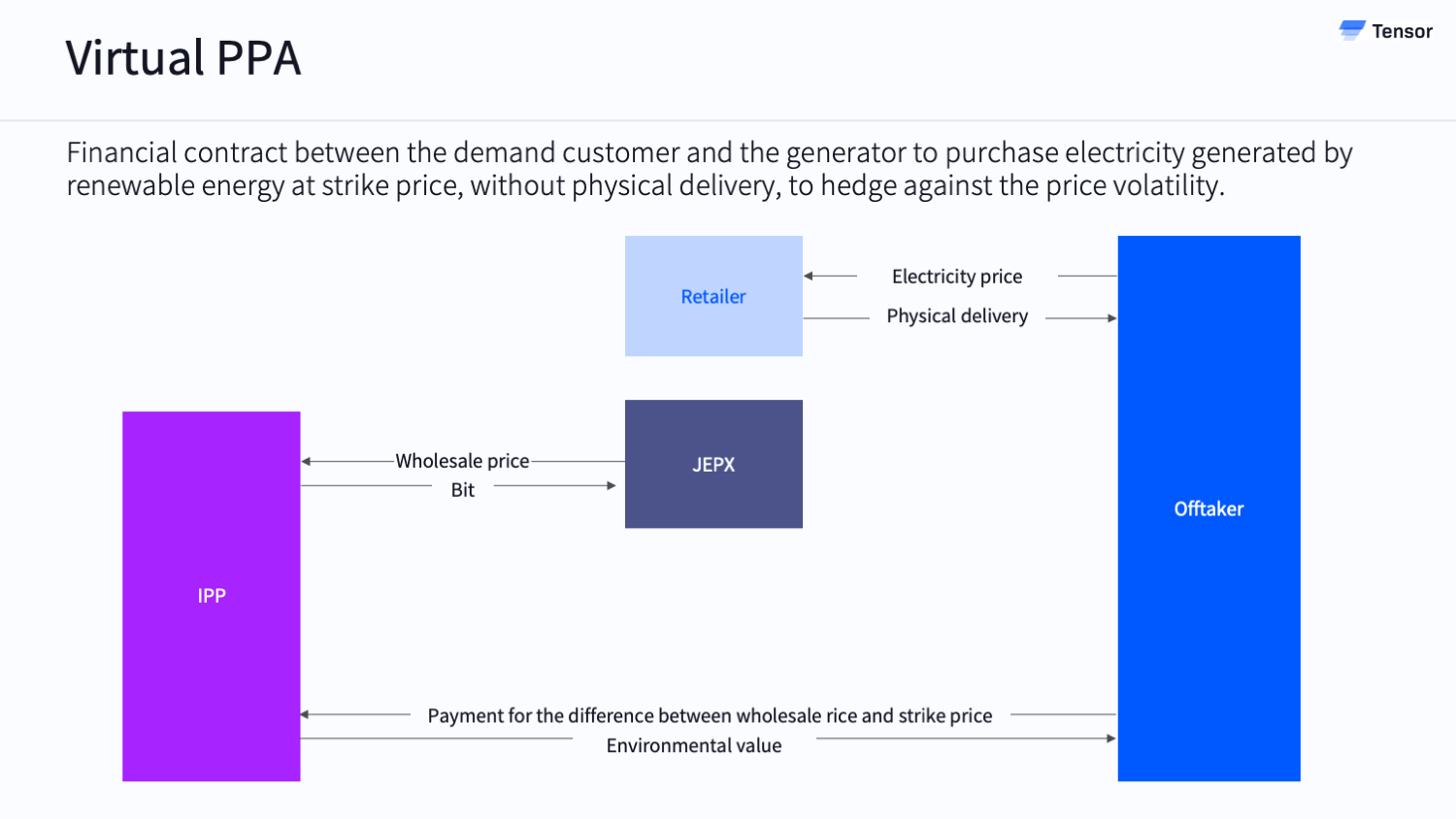

There are many considerations when considering PPAs, including the type of PPA (off-site, self-commissioning, on-site, virtual PPA, etc.), contract term, customer, pricing terms (fixed price, variable price, price guarantee or differential settlement, etc.), and recipient of FIP premium. We will therefore introduce several strategic measures for PPA pricing.

Exhibit 2

An example is the diversification of contract types. To meet the needs of various clients and market conditions, we offer a combination of short-term and long-term PPAs. Short-term contracts allow for higher prices during periods of high demand, while long-term contracts provide for more stable revenues. By choosing not only the length of the contract but also a fixed price or a pricing structure that sets a maximum and minimum limit, customers can lower their risk while reducing the volatility of their generation costs. In addition, value-added services can increase the attractiveness of PPA contracts and differentiate them from competitors. Specific examples include solar + storage solutions and energy efficiency initiatives. Combining solar and storage batteries can improve the stability of energy supply and provide solar-generated power during peak electricity demand periods. In addition, by incorporating energy efficiency into PPAs, power producers can reduce fuel and material costs and generation costs by using fewer resources to produce the same amount of electricity. This added value can be added to the PPA price to increase their selling price.

Introduction to Tensor Cloud

Tensor Cloud is an essential tool in the power plant development process; it can handle various PPA structures, making it easy to validate and compare. Drivers affecting profitability can be identified and better understood before negotiations with customers.

Conclusion

There are multiple pricing strategies for PPA contracts. It is important to consider risk allocation while meeting customer needs and differentiating yourself from competitors by diversifying contract types and offering value-added services.

Authors

Hina Susanna Hayashi

Marketing Intern